This is An Example Agreement.

Credit Repair Services Agreement

Client listed on this agreement (hereinafter “Client”) engages and retains CBC Financial Group, LLC dba The Credit Agents, (hereinafter “T.C.A.”) with a principle address of 11211 Katy Fwy. Ste. 570, Houston, TX 77079 for the purpose of credit report analysis, document review and audit and verification services to the three major credit bureaus: Equifax, Experian and Trans-Union; under the following terms and conditions: T.C.A. will help Client obtain credit reports. Once received, T.C.A. will analyze Clients credit reports to identify any items the Client believes may be inaccurately appearing on any of their credit reports. T.C.A. will use written materials and industry knowledge to persistently challenge any inaccurate credit items that Cli¬ent identifies as inaccurate or erroneous by drafting and sending targeted disputes and/ or interventions to the three major credit bureaus and/or creditors on Client’s behalf and in Client’s name on a regular basis while enrolled. Under the Fair Credit Reporting Act (15 U.S. Code § 1681(a) - 1681(t)) the Credit Reporting Agencies are required to open a dispute, notify the data furnisher of the dispute, and complete the investigation within thirty (30) days. Client will receive three individual updated credit reports by mail approxi¬mately every 30-45 days. In order for T.C.A. to track progress of investigation results, Client must keep an active and approved credit monitoring website service. When T.C.A. receives the investigation results from Client’s credit monitoring website account, T.C.A. will carefully review them and determine what will be challenged next and on what basis. This process is repeated until all of the inaccurate or erroneous information has been corrected or verified as accurate by a creditor or credit bureau, or until Client cancels, whichever comes sooner.

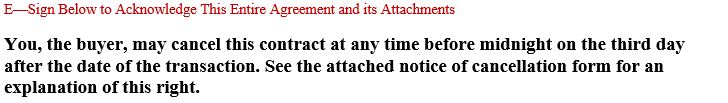

RIGHT TO CANCEL AND CONSUMER CREDIT FILE RIGHTS UNDER FEDERAL 6 STATE LAW. Two separate documents, titled “CONSUMER CREDIT FILE RIGHTS UNDER STATE AND FEDERAL LAW” and “NOTICE OF CANCELLATION” are required by the Federal Trade Commission and have been sent for Client review. These documents must be read and accepted before this service agreement is deemed valid and T.C.A can commence services. By signing this agreement, you affirm that you have read and understand both attachments.

DISCLAIMER: THE CREDIT AGENTS WORK TO RESOLVE CREDIT ISSUES SUCH AS IDENTITY THEFT, MIXED CREDIT FILES, DUPLICATES AND OTHER INACCURATE, OUTDATED OR QUESTIONABLE INFORMATION. SERVICE FEES ARE BILLED ONLY AFTER THE SUCCESSFUL DELETION OF SUCH ITEMS ON CLIENT’S CREDIT REPORTS. WE DO NOT CLAIM TO, NOR CAN WE, DELETE ACCURATE INFORMATION FROM CONSUMERS CREDIT REPORTS AND RESULTS DO VARY.

Initial Setup Fee - $349

(Billed once, only after initial set up has been completed). INITIAL SETUP FEE INCLUDES: Review and assess the Clients current credit standings, and consult with the client as to the information contained within their credit report with a focus on determining if any information on credit report is inaccurate, outdated or unverifiable. • Enter all applicable data from Client’s credit report into secure internal database. • Client’s file is prepped and investigations/challenges plotted to include the items that Client has indicated to be reporting erroneously per the Client’s affirmation. • Company will then prepare the individual investigations and/or challenges to each of the three major credit reporting agencies (Experian, Trans Union, and Equifax) and send them.

Deletion Fees: Range $25 to $125 per account per bureau deleted.

Deletion Fees are only invoiced after the successful deletion of any of the items below. If T.C.A is unable to remove any negative items from Client’s credit report by the end of the term, no fees will be due.

• $25 per personal record per bureau (address, name, SSN, DOB) • $50 per inquiry per bureau • $50 per collection per bureau • $50 per charge-off per bureau • $50 per late payment reported per bureau • $125 per public record per bureau • $125 per auto account (repossession or auto charge-off) per bureau • $125 per alternative data report deletion (LexisNexis, ChexSystems, NCTUE, etc.) • $125 per child support account per bureau • $125 per foreclosure per bureau • $125 per broken lease or derogatory lease account per bureau

SPECIAL ARRANGEMENTS

Initial Audit Fee:

Draft Date 1:

Draft Date 1 Amount:

Draft Date 2 (If Applicable):

Draft Date 2 Amount (If Applicable):

The Company's services are estimated to be provided for 6 months from the date of first payment draft. As such, the Client will pay an estimated maximum total of $1,500. In the event a new item is added to Client’s credit report after the date of this signed agreement and Company disputes the item on behalf of Client, the estimated maximum total amount may increase. Client can cancel at any time. However, if Client cancels this Agreement, Client shall be responsible for payment of any and all amounts owed for deleted items that are the result of work performed through the time of cancellation.

Our billing department handles all billing and payment inquiries. Client will direct ALL payment & billing inquiries to 281-756-7060 or [email protected] Client may update billing information using the secure online portal. Client can change or stop billing date via email or text.

T.C.A. charges Client retroactively. After the successful deletion of an inaccurate item, an invoice will be created for the balance due. Client will be notified by text or email when an invoice has been created. Client will be given a 3-day grace period to either pay the invoice in full or make a payment arrangement if needed with T.C.A. If no response by close of business on the 3rd day of invoice created, T.C.A. will attempt to pro¬cess payment due to card on file. If payment fails to process for payment in full, T.C.A. will attempt to charge credit card for a lesser amount. If Client is unable to pay invoice in full, Client may request an installment arrangement with the billing department. If Client fails to pay or make payment arrangements for 30 days after invoice is due, the Client’s services will be cancelled and any remaining balance will be due immediately.

In the event that Client contacts his/her bank for a chargeback of fees already earned for deletion fees, this notice will serve as evidence that this agreement is binding and the bank is to refund T.C.A. any fees, which have been charged back.

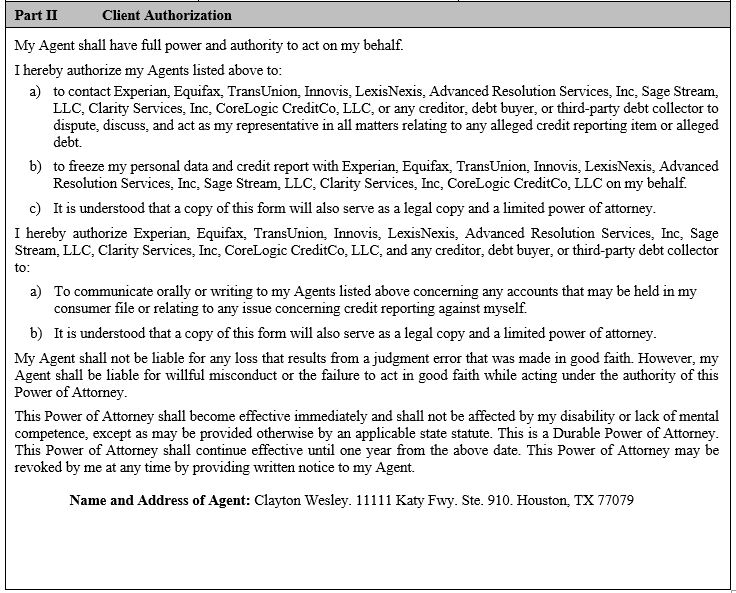

The Credit Agents will need permission from you to communicate with the credit bureaus and possibly creditors and others, in your name and on your behalf, including writing and transmitting letters and documents in your name. This is a Limited Power of Attorney, granting permission to T.C.A. to do this. It authorizes and directs T.C.A. to act as your disclosed and undisclosed agent when performing the services you have retained T.C.A. to provide. You can cancel your authorization, and the Limited Power of Attorney, at any time by sending T.C.A. a written and signed letter stating that you retract your authorization. Without this authorization and Limited Power of Attorney, T.C.A. is unable to represent you, and canceling it will prevent T.C.A. from performing its duties. Please make a copy of this Agreement for your records. KNOW BY ALL, I/We, the undersigned and Principal(s), have the right and hereby make, constitute and appoint T.C.A. (Herein referred to as “Agent”) as my/our true and lawful Agents. Giving unto said Agent, the full power to do and perform all and every act that I/we may legally do, and every power necessary or convenient to carry out the specific purposes for which this power is granted and I/we hereby ratify all lawful acts of my/our Agent. Specific Purpose: To proactively dispute and verify any erroneous and inaccurate information in regards to my/our credit report(s) or with any company/person furnishing information to the credit repositories, and to perform any lawful act necessary to conduct such an investigation and remove any inaccurate, non-current, invalidated, unverifiable information and referral to an account negotiation service. The undersigned’s Agent is authorized to furnish a copy of this Agent Representation to credit bureaus, creditors, collection agencies, or others associated with the Client’s accounts. The undersigned’s Agent may designate one or more employees, agents, or third parties to assist in these services. The recipient of an original, photocopy, e-mail or facsimile of this document is specifically instructed by the undersigned to communicate with the designated Agent. This AGENT REPRESENTATION is effective upon signing by the principals and specifically authorizes the recipient to discuss, disclose and convey documents, and otherwise provide information to the described AGENT in the same manner recipient would otherwise provide and disclose to the undersigned principals. This AGENT REPRESENTATION authorizes my Agent to draft letters on my behalf; obtain, review and discuss my consumer credit report; bank and creditor account information; medical bills and condition; employment status; financial information (whether public or non-public), and any other personal information about me that is necessary or convenient to resolve the designated matters.

Client and T.C.A. agree that any dispute (contract, warranty, tort, statutory or otherwise), including but not limited to: (a) Disputes or claims arising from or related to this Agreement and any amendment hereto; (b) Disputes or claims arising from a representation, omission, promise or warranty allegedly made by or on behalf of T.C.A.; and (c) Disputes or claims arising from or related to the Credit Repair Organizations Act (or other applicable federal, state or local law, statute or ordinance), shall first be submitted to mediation and, if not settled via mediation, shall thereafter be submitted to binding arbitration (using a single arbitrator) pursuant to the Federal Arbitration Act or, if applicable, similar state statute, and not by or in a court of law. All deci¬sions respecting dispute arbitrarily shall be decided by the arbitrator. The arbitrator shall issue a binding written decision resolving all issues of law and fact. The arbitrator may award the prevailing party, if any, as determined by the arbitrator, all or any portion of its costs and fees. “Costs and fees” may include rea¬sonable expenses, including mediator / arbitrator fees, administrative fees, travel expenses, out of-pocket expenses, witness fees and reasonable attorney’s fees. Arbitration shall take place pursuant to the Amer¬ican Arbitration Association Commercial Arbitration Rules. If any conflict exists between this Agreement and such procedures, the provisions of this Agreement shall control. If the parties cannot agree upon a mediator and/or arbitrator, either party may petition a court of general jurisdiction in Harris County, Texas to appoint a mediator and or arbitrator. Such action shall not constitute waiver of the right to enforce bind¬ing arbitration. The parties agree that notwithstanding anything to the contrary, the rights and obligations in this mediation-arbitration provision shall survive (1) termination of this Agreement by either party; or (2) default of this Agreement by either party. Given that this Agreement provides for mandatory mediation and arbitration, if any party commences litigation in violation of this provision, such party shall reimburse the other parties to the litigation for the costs and expenses, including attorneys’ fees, incurred in seeking to abate such litigation and compel arbitration. (d) Either party may bring claims against the other only in his/her or its individual capacity and not as a plaintiff or class member in any purported class or representative proceeding.

This Agreement is made and entered into in the State of Texas, shall be performed within the State of Texas, and shall be interpreted, enforced, and governed by the laws of that state without regard to the conflict of laws. Venue for any dispute between the parties shall be in Harris County, Texas. The Company’s Texas agent authorized to accept service of process is XQ CPA PLLC. 11511 Katy Freeway. Suite 630. Houston, TX 77079

In order for T.C.A.’s services to be effective, it is critical that this entire agreement and each of the following line items is fully understood and agreed to. Failure to read, acknowledge and agree to the terms set below can have a negative impact on benefits and outcome of our services. Should a dispute or com¬plaint arise during or after the completion of the program, we will provide you with a copy of this legally signed agreement. I acknowledge and agree to the following:

1) To notify T.C.A. of items Client identifies as inaccurate or not belonging to Client. This is submitted verbally to any T.C.A. representative at time of enrollment or via their secure online portal. Client recognizes that there is questionable derogatory information on his/her credit reports and requested T.C.A. to dispute the items to verify their accuracy. If there are any accurate items OR items the Client does not wish to have disputed it is the Clients responsibility to make T.C.A aware of these items before the process begins so they will not be disputed, because of T.C.A.’s correspondence, Client will receive credit reports free of charge after each dispute cycle and/or correspondence from creditors in response to T.C.A.’s interventions. Additionally T.C.A. may periodically request updated credit reports and Client is required to furnish the re¬ports upon request to ensure accurate audit and verification on the Clients behalf.

2) Every credit report is different and because of this, no one can guarantee a specific outcome or accurately predict how long this process will take, including T.C.A. It may take up to six months depending on many factors such as: • Number of adverse and derogatory items • Age, type, balance and source of items present • Responses from Experian, Equifax and Trans-Union

3) I am requesting and authorizing T.C.A. to conduct a complete and thorough verification of the information reporting in my credit file(s) with the credit bureaus, creditors, collection agencies and/or any other entity in my name and on my behalf and I hold T.C.A. harmless to actions brought against me by use of such corre¬spondence.

4) I will provide T.C.A. with true, complete, and accurate information, and will not knowingly direct or enable T.C.A. to submit false or inaccurate information on my behalf. If I become aware of any such inaccuracy, I will immediately notify T.C.A. in writing.

5) By signing this agreement I have hired T.C.A. to send disputes and/or interventions and I understand the credit bureaus are required under Federal law to send me the results by mail each time a dispute has been received. The results should arrive via U.S.P.S. mail individually and occasionally as duplicates. I am respon¬sible for keeping these results in my records in case T.C.A. requests a copy. I understand that T.C.A. will continue to send the disputes until I cancel in writing, until T.C.A. has deemed my credit reports 100% accurate, or until the term of this agreement has expired. In the unlikely event I do not receive responses from the credit bureaus by mail every 60 days, I understand that it is my responsibility to contact T.C.A. and advise them of the issue.

6) I authorize T.C.A. to request credit reports from Equifax, Trans-Union and Experian on my behalf T.C.A. has the right to cancel my account and/or release me from future obligations at any time for any reason.

7) I understand T.C.A. is not a law firm and does not provide legal services or legal advice.

8) I can access my online account 24/7 at www.CreditAgents.com and can login on a regular basis to view my progress. If I lose my password, I can perform a password reset or contact Client Services for assistance.

9) T.C.A. has advised me that I can attempt to correct errors on my credit reports free of charge and I do not need to hire a third party. I understand my rights and have elected to hire T.C.A. to perform these services as a convenience. T.C.A. does not claim that any accurate item can or will be removed from my credit report.

10) I understand that while in T.C.A.’s program that I will receive audit / investigation results in the mail, fur¬thermore I understand that these results do NOT have updated credit scores. In order for T.C.A. to track the progress of my credit scores, I am required to maintain an active and approved Credit Monitoring service.

11) I understand that T.C.A. cannot guarantee the removal of any specific item from my credit report, and that T.C.A. seeks to obtain an accurate credit report on my behalf. T.C.A. does not guarantee a score increase or certain outcome. Credit improvement is based on the removal of inaccurate information and the aspect of bettering my credit may require paying down debt, settling past due accounts and/or building new positive trade references.

12) I understand T.C.A. does not charge before work has been performed.

13) To collect fees, I grant T.C.A. permission to withdraw the funds and/or dishonored payment fees (if appli¬cable) from my credit or debit card. In the event my account is past due, I grant T.C.A. permission to draft my past due balance and dishonored payment fees at any time regardless of how far past due I am and without prior notification. I agree to provide updated billing information to T.C.A. within (5) business days at all times and further agree to have funds available for payment when payment is due as outlined in this agreement.

14) If I move, I will notify T.C.A. within 10 days and provide them with an updated copy of my driver’s license as well as two new proofs of residence.

15) I understand that T.C.A. may communicate with me throughout the program by phone, text, and email. I understand that mobile data rates may apply.

16) I understand the Company will not remove any derogatory information (defined as accurate negative information appearing on a Client’s credit report that actually belongs there), nor will the Company assist me on improving my credit rating. Instead, as a Texas compliant credit repair organization, the Company exclusively will assist me in removing or correcting inaccurate information appearing on my credit report(s).

17) I understand that T.C.A. may contact me on any telephone numbers provided by me via the use of an auto-dialer, SMS text, or by using a pre-recorded message. I also understand that this consent does not require me to make any purchase and that T.C.A. may contact me irrespective of whether my telephone numbers appear on any state or federal “Do Not Call” lists.

A representative from T.C.A. has discussed the information outlined in this agreement. I fully understand all of the content within.

Client Information

SSN# :